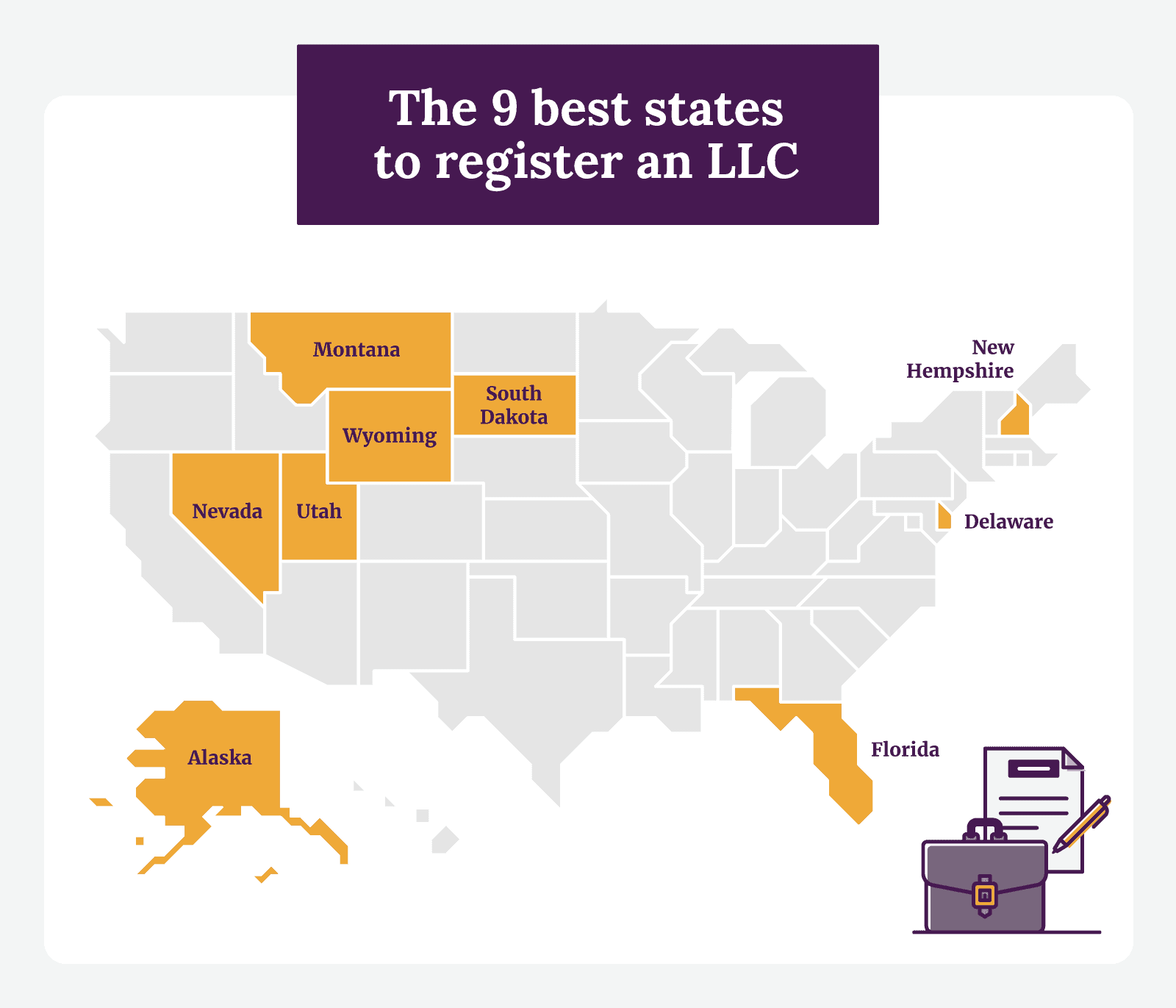

Wyoming, Nevada, and Delaware are considered some of the best states for setting up an LLC. Where your LLC is registered can affect many facets of your new business’s operation.

In this guide, we’ll cover the benefits the most desirable states have to offer as well as some additional tips for properly registering your LLC.

No time to read? Here’s a short video explaining everything you need to know.

Overall, the most desirable states have won their place as business owners’ favorites for various reasons (privacy, personal asset protection, corporate tax rate, lack of hassle or additional fees, real estate, bank accounts, and more).

Some common motivations business owners relocate are more favorable tax requirements and a thriving business climate.

Registering an LLC in Wyoming is one of the most advantageous for new business owners due to their privacy policies and reduced taxes.

Registering an LLC in Nevada comes with many tax advantages for business owners. There’s also increased privacy protection for actively participating members.

Delaware is one of the most sought-after states to start an LLC. Thanks to their increased privacy protection, the special corporate court system, and limited fees and taxes.

Alongside a thriving tourism industry, Florida attracts many entrepreneurs to start their LLCs in the state due to the reduced costs of running a business and an entrepreneur-friendly economy.

Many choose to start their LLC formation in Montana to avoid paying taxes and optimize their business income.

Utah is another business-friendly state that attracts many entrepreneurs since its business climate provides some of the best business survival rates.

South Dakota is regarded as a good option for starting an LLC due to the variety of financing programs and overall low taxes required by the state.

Although considered one of the stricter states when it comes to LLC requirements, New Hampshire still has many benefits for owners who register in the state.

Even though Alaska may be considered a very remote place to start an LLC in the U.S., there are still many advantages for business owners looking for reduced taxes.

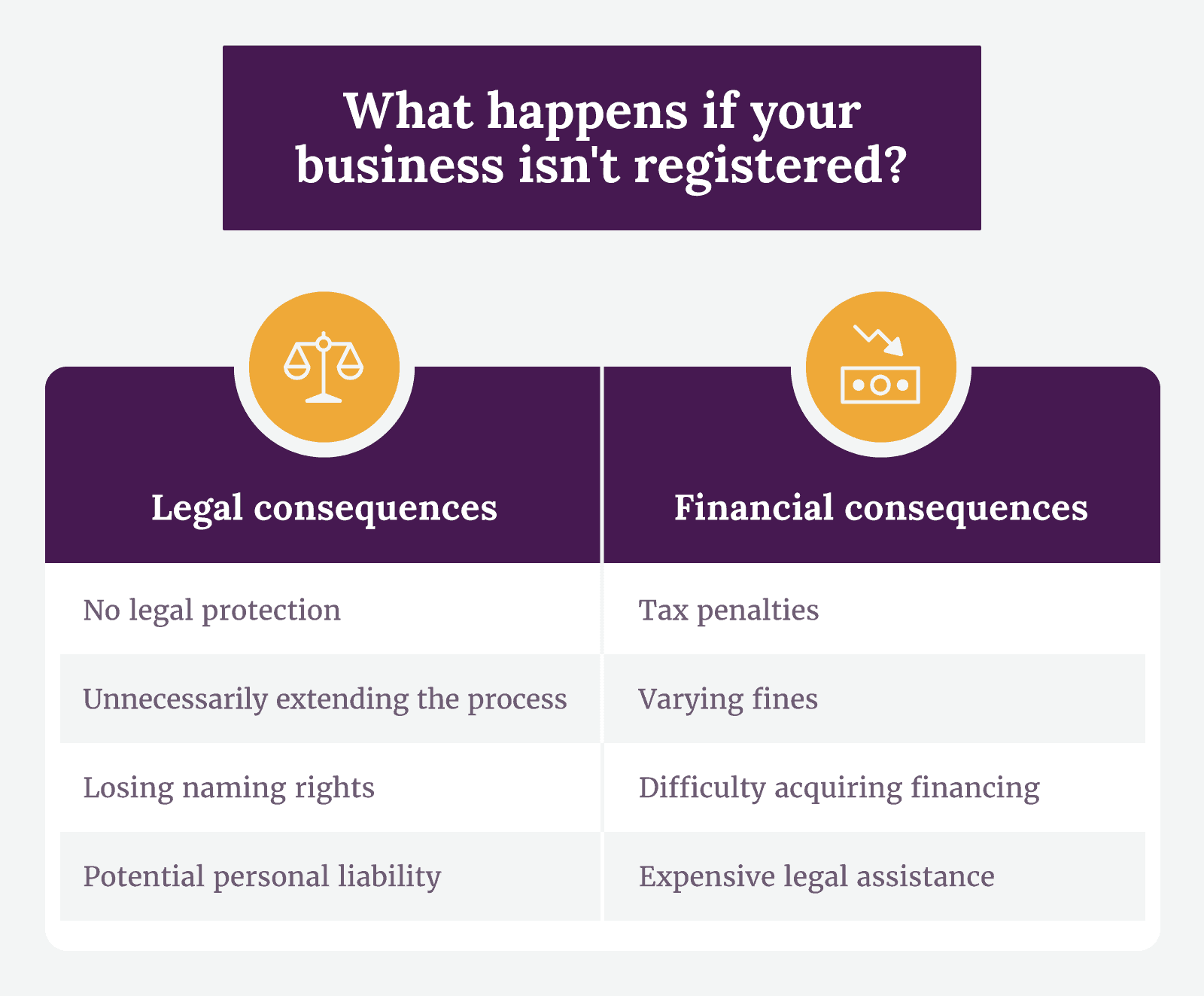

If you have a great idea in mind, you’re likely eager to hit the ground running. However, the registration process can be lengthy, and not registering your LLC properly comes with many consequences.

Conducting business without registering your LLC comes with quite a few legal implications. To avoid the consequences below, make sure you start your LLC properly, file the necessary tax returns, and provide annual reports for your business matters.

Outside of the legal consequences associated with not registering your LLC under the correct business structure, there are many financial consequences you may face. The cost of these financial ramifications can quickly add up, especially for a small business owner who isn’t a large corporation with capital to spare.

Even if you don’t have a physical storefront or place of business for your goods and services, you’ll still need to register your online business as an LLC in your desired state of operation. Thankfully, without the need for a physical location, an e-commerce business may be easier to register as a foreign LLC.

If you have a solid business plan in place and have considered the best state to form an LLC, you’re on your way to becoming a successful business owner. Gather resources from your state of operation’s government and acquaint yourself with the ins and outs to avoid the potential legal and financial consequences outlined here.

The state where you file your LLC mainly affects how you pay taxes, the tax percentage, and what the business is taxed on.

For example, some states will forgo a sales tax while others will implement a sales tax for businesses.

Likewise, the location of your LLC will affect which business state laws you’ll be required to follow. Each state has its own set of unique business laws, so be sure to double-check a state-sponsored resource, like this Florida guide.

You’re likely wondering, “Can I use my LLC in another state?”

The short answer is yes, you can.

But as a rule of thumb, the best state to register your LLC is your home state.

Consider all the pros and cons before moving your business out of state.

When the LLC is registered in the owner’s home state, this is known as a domestic LLC. Conversely, an LLC registered in a state that isn’t the owner’s home state is known as a foreign LLC.

For example, if you live in California but register your LLC in Nevada, your business would be a foreign LLC.

For the sake of simplicity, new small business owners will usually register their LLC in their home state. However, it’s not uncommon for entrepreneurs to register their business in a state outside of their own.

New business owners opt to register a foreign LLC to benefit from other states’ LLC tax advantages.

Registering a domestic LLC comes with many advantages. For one, you and the appointed registered agent will remain in the same state. If you register your LLC in another state, the registered agent will need a physical address there.

Likewise, any record-keeping or annual reporting will only go to your home state’s respective office, keeping the paper trail nice and neat.

A significant drawback of registering a domestic LLC is if your state imposes higher business taxes, you must comply with them once your business opens.

For example, if your home state has a business enterprise tax, the state will expect a certain percentage of your revenue to go toward complying. If your home state is somewhere like California or New York with high personal income tax rates, you may want to acquire a business license elsewhere.

A considerable benefit to registering a foreign LLC is the ability to take advantage of another state’s thriving business climate and business-friendly tax rates. Business owners flock to different states for this reason alone.

On the other hand, one of the more notable cons is that the registration process varies from state to state. You’ll possibly have to do a deeper dive into the requirements if you’ve never opened a business in your desired state.

There will likely also be additional filing and annual fees when registering outside your home state.