Updated from an original article written by Dennis Pennington, and Dennis Stein, Michigan State University Extension.

This series covers the factors you should take into consideration when renting out your farm land.

Over the years, producers have rented farmland to each other, also known as “swapping ground”, for a wide variety of reasons using a wide range of different types of arrangements. The type of agreement usually has a lot to do with how involved a landowner wants to be in the crop production activities on their land. Some landowners don’t want any production or market risk or to be involved in making production decisions. Some want to own part of the crop. Some might want to be able to market their share of the crop. There is great flexibility in agreements based on what fits the landowner needs and the tenant needs. Here is a basic summary of farmland rental agreements.

The most popular and most frequently used farmland rental arrangement is fixed cash rent agreement. The landowner receives a predetermined fee to be paid by the tenant regardless of crop price or yield. The landowner is not usually involved in making any of the management decisions nor pays for any of the inputs. Normally these agreements are ongoing for multiple years based on a simple written agreement. A cash rent arrangement could be as short as one growing season in length which then requires renewal each year. Every cash rent agreement can have different terms and conditions depending on the situation but needs to establish the rental rate, payment schedule, length of agreement (beginning and ending date), and any crop or other restrictions. Putting agreements into a document that both landowner and renter sign is always the recommended practice. This option is good for landowners who want to eliminate uncertainty and risk, which a set, flat rate provides.

Crop share is considered a flexible farmland rental agreement where the landowner and tenant split the income from crops being grown on the farm in a pre-established ratio or percentage. A common share agreement would be 25% to landowner and 75% to tenant of the harvested grain crop when the landowner does not share in any production costs. In some cases a 1/3 to the landowner and 2/3 to the tenant agreement is used but in this this case the landowner would be expected to pay for 1/3 of the seed, fertilizer and chemicals cost for producing the crops. With input and overhead costs increasing over the past 10 years tenants can no longer afford the historical shares where 1/3 to the landowner with 2/3 going to the tenant with no cost share. This is different from the fixed cash rent agreement in that the price paid to the landowner is based on income, not a fixed amount. The dollar amount will be impacted by crop yields and prices. When yields and prices are up – rent amount will be up and vice versa.

A flex rent agreement is a way to share the risks and rewards of a crop production system. Often the formula can promise a base cash rent price, which is often paid in advance, with a possible bonus at harvest, which is based on the gross value (yield times price) of the crop flex rent. Flex rent landlords may receive much higher rents, possibly better than some of the highest cash rents in the area. In the case of a revenue disaster, the tenant, are only obligated to pay the base cash rate. This option has become very popular across much of Michigan over the past few years as commodity prices rallied much higher than most expected. The use of this type of agreement provided the landowner with large bonus payments. The comfort level of accepting risk impacts the flex rent decision, as some landlords prefer guaranteed, set cash rent.

As an alternative to the share crop arrangement is a fixed bushel agreement with landlords. The rent payment is a set number of bushels of grain per acre to the landlord. For example, a corn rent might be 40 bushels of corn per acre. The bushel rent is delivered to the local elevator in the landlord’s name, which means the landowner has the opportunity and responsibility to market the grain. When the corn sales price is high, rental income to the landowner increases, while in lower price years the rental income goes down. The marketing ability of the landowner could significantly affect his income. The tenant and landowner will need to establish a schedule of the crops to be grown and the bushels that will be considered as the rental payment for each of these crops. In this agreement, the landowner does not have production risk, but does have marketing risk.

Some flex agreements offer a fixed price per bushel multiplied by the average corn yield for that field. (Corn example: $1 times the average yield, i.e. 150 bushels per acre, produces cash rent of $150 per acre.) This relieves the landowner of marketing and production risk and ties the rent price to the productive capacity of each field, which is good for the tenant.

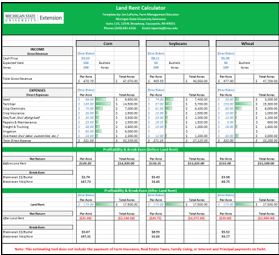

MSU Extension offers a Land Rent Calculator designed to assist producers in comparing the impact of land rent payments against their farm's Net Farm Income. By inputting estimated income and expenses, a producer can determine whether the land rent being paid is reasonable or if a discussion, or even a possible re-negotiation, of the land rent agreement should take place. This tool is available on the MSU Extension Farm Management website.

Use the calculator to discuss rental values with landowners so that they can be better informed about the challenges that exist on their property and the potential impacts to the farm's production and profitability. Producers can then work with landowners to develop a rental agreement that will benefit both parties; ensuring the retention of acres for the producer and steady rental income for the landowner over many years.

For information on average rental rates in your county, visit the following report based on survey data from the USDA’s National Agricultural Statistics Service for Michigan counties. For a copy of this entire series in a fact sheet format, please visit the following web address.