Interagency Overview of the Community Reinvestment Act Final Rule

On October 24, 2023, the Office of the Comptroller of the Currency, the Federal Reserve Board, and the Federal Deposit Insurance Corporation issued a final rule to strengthen and modernize regulations implementing the Community Reinvestment Act (CRA) to better achieve the purposes of the law. The CRA is a landmark law enacted in 1977 to address systemic inequities in access to credit. The CRA encourages federally insured banks to help meet the credit needs of the communities in which they do business, especially low- and moderate-income (LMI) communities, consistent with safe and sound operations.

The final rule and other supporting materials (including a press release and fact sheet) can be found on each agency's respective website.

Objectives and Key Elements of Final Rule

The agencies recognize that the CRA regulations must evolve to address the significant changes in the banking industry that have taken place since the last comprehensive interagency update in 1995.

Building on feedback from stakeholders and research, the final rule updates the CRA regulations to achieve the following eight key objectives:

- Strengthen the achievement of the core purpose of the statute.

The rule seeks to ensure that the CRA continues to be a strong and effective tool to address inequities in access to credit. To achieve this objective, the rule

- evaluates bank engagement with LMI individuals and communities, small businesses, and small farms, including conducting separate assessments of large bank activities using four tests: (1) retail lending, (2) retail services and products, (3) community development (CD) financing, and (4) CD services

- enhances financial inclusion by supporting Minority Depository Institutions and Community Development Financial Institutions, Native Land Areas, persistent poverty areas, and other high-need areas

- emphasizes smaller loans and investments that can have high impact and be more responsive to the needs of LMI communities

- Adapt to changes in the banking industry, including the expanded role of mobile and online banking.

The rule recognizes the significant changes in bank business models and how banking services are delivered, including through the use of internet and mobile banking and hybrid models that combine physical footprints with online lending. To achieve this objective, the rule

- maintains a focus on evaluating bank performance in areas where banks have deposit-taking facilities while also evaluating retail lending activities occurring in “Retail Lending Assessment Areas” outside of these areas. The new rule also provides consideration for banks’ community development activities nationwide

- Provide greater clarity and consistency in the application of the regulations.

The rule addresses feedback on the need for more clarity and consistency in the application of the CRA regulations. To achieve this objective, the rule

- adopts new metrics and benchmarks used by the agencies to assess retail lending performance that translate into performance conclusions

- encourages CD activities that are responsive to the needs of LMI individuals and communities, small businesses, and small farms by clarifying what activities will receive CRA credit (such as affordable housing), providing for a public list and approval process to confirm an activity's eligibility, and evaluating CD activities in light of their impact

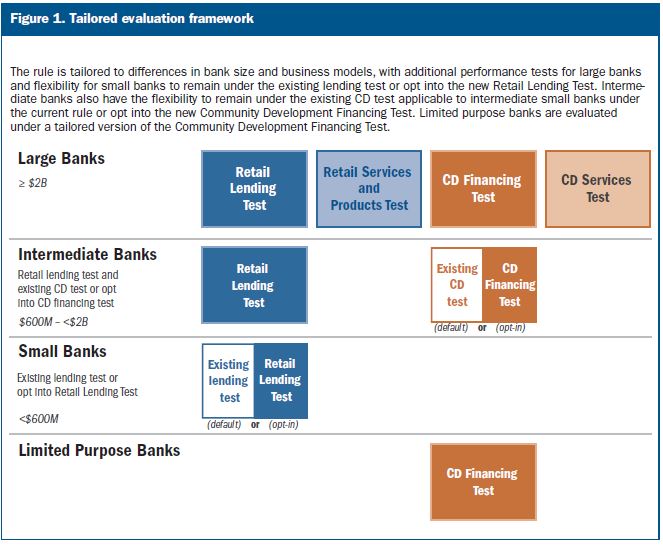

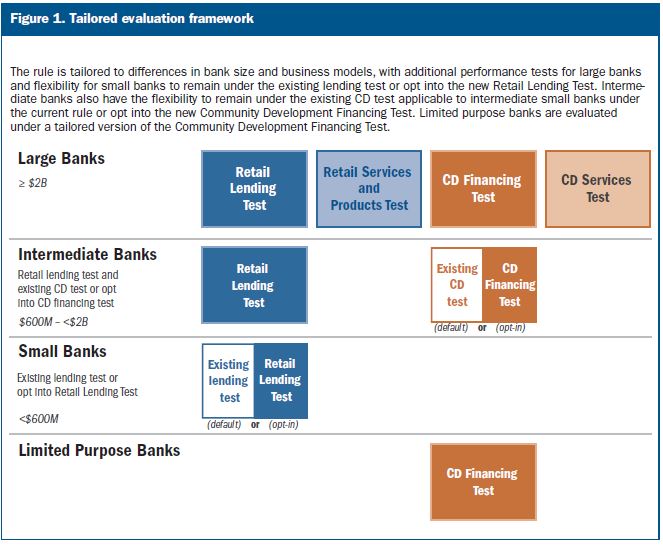

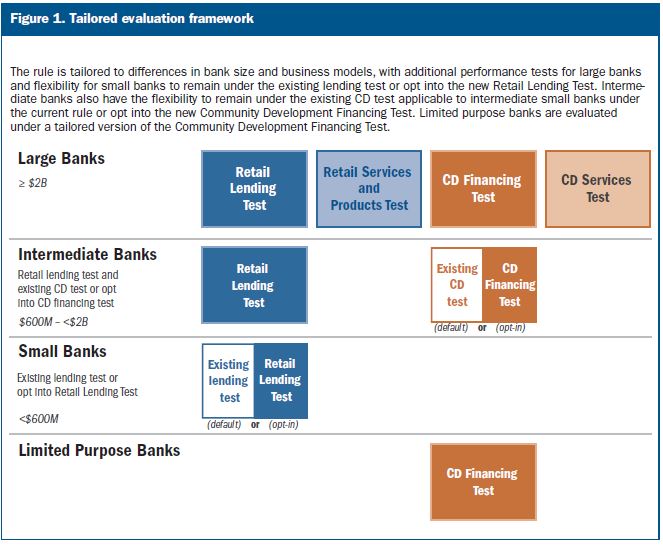

- Tailor performance standards to account for differences in bank size, business models, and local conditions.

The rule recognizes differences in bank size and business models. To achieve this objective, the rule

- updates asset size thresholds for small, intermediate, and large banks to account for changes in the banking industry: (1) small banks:

- utilizes community and market benchmarks that reflect differences in local conditions

- continues to provide a tailored performance evaluation framework with different performance tests based on bank size and business model (see figure 1). For example, small banks will continue to be evaluated under the existing framework with the option to be evaluated under the new framework.

- Tailor data collection and reporting requirements and use existing data whenever possible.

The rule seeks to strike an appropriate balance between minimizing unnecessary burden on community banks and providing greater clarity and consistency in how large banks are assessed by establishing the use of standardized metrics for certain banks and tailoring the associated data collection, maintenance, and reporting requirements. To achieve this objective, the rule

- exempts small and intermediate banks from new data collection requirements that apply to banks with assets of at least $2 billion

- limits certain data collection and reporting requirements to large banks with assets greater than $10 billion

- Promote transparency and public engagement.

The rule recognizes that transparency and public engagement are fundamental aspects of the CRA evaluation process. To achieve this objective, the rule

- provides greater transparency for existing data available under the Home Mortgage Disclosure Act (HMDA)—related to the race, ethnicity, and income of bank borrowers and applicants—for large banks, by assessment area. Data will be provided on agency websites for disclosure purposes only

- codifies the practice of forwarding to the bank all public comments received by the agencies regarding a bank's CRA performance

- encourages the public to submit comments on community needs and opportunities

- provides in supplementary information that the agencies will develop data tools that use reported loan data to calculate metrics and benchmarks in different geographic areas in recent years, allowing banks and the public to have additional insight into the performance standards

- Confirm that CRA and fair lending responsibilities are mutually reinforcing.

The rule affirms that, in meeting the credit needs of their entire communities, banks must do so in a fair and equitable manner. The rule

- continues to prohibit banks from delineating facility-based assessment areas that reflect illegal discrimination or arbitrarily exclude LMI census tracts

- retains and clarifies the provision that CRA ratings can be downgraded as a result of discriminatory and other illegal credit practices

- Promote a consistent regulatory approach that applies to banks regulated by all three agencies.

The rule recognizes the importance of consistency across the three agencies. The rule

- provides a unified approach from the three banking agencies that is responsive to feedback from stakeholders on the need for consistent regulations

Key Changes in Final Rule

Based on an analysis of comment letters and further agency review, the final rule includes the following key changes from the proposed rule

- Reduces complexity and data requirements while providing a consistent and comprehensive approach to evaluating banks under the Retail Lending Test.

- reduces the number of major product lines potentially evaluated under the new Retail Lending Test from six to three: (1) closed-end home mortgage loans; (2) small business loans; and (3) small farm loans

- limits the evaluation of automobile lending to banks subject to the Retail Lending Test that

- are majority automobile lenders (i.e., banks for which more than 50 percent of their lending comprises automobile loan purchases or originations, out of total automobile, home mortgage, multifamily, small business, and small farm lending); or

- opt to have their automobile lending evaluated

- Adjusts retail lending performance ranges while maintaining high standards; also increases weighting of CD financing activities

- adjusts standards to make “Low Satisfactory”, “High Satisfactory”, and “Outstanding” conclusions under the Retail Lending Test more achievable while still maintaining appropriate and locally calibrated standards

- for large banks, gives equal weight to retail activities and CD activities (compared to a proposed 60 percent retail/40 percent CD split). The equal weight was broadly supported by stakeholders to encourage banks to focus on CD activities in addition to retail activities by providing additional emphasis in the banks' ratings

- Retains evaluation of banks with significant retail lending outside of branches while increasing tailoring of the retail lending assessment area approach.

- tailors requirements for delineating retail lending assessment areas (RLAAs):

- based on recent lending patterns, about one-quarter of large bank mortgage lending and nearly 40 percent of small business lending that is outside of FBAAs would be evaluated for the first time in RLAAs

- exempts banks with branch-based business models (banks with 80 percent or more of retail lending within facility-based assessment areas)

- increases the loan count thresholds that would trigger RLAAs (from 100 to 150 closed-end home mortgage loans, and from 250 to 400 small business loans)

- reduces the number of product lines potentially evaluated in RLAAs: home mortgage loans or small business loans are only evaluated if the specific product line meets the triggering thresholds; other product lines are not evaluated in RLAAs

- based on agency analysis of 2018–20 CRA historical data, the agencies estimate that the changes described above would reduce by about half the number of large banks that would be required to delineate RLAAs and the number of RLAAs that would be created based on prior year lending. The approach would still evaluate banks with significant concentrations of retail loans outside facility-based assessment areas

- Adds metric and impact factor to evaluate bank CD investments under the CD Financing Test.

- adds additional metric to CD financing evaluations, focusing on certain CD investments relative to deposits for banks greater than $10 billion, to enable examiners to evaluate bank investments under the Low-Income Housing Tax Credit and the New Markets Tax Credit programs. Strong bank performance under the metric would be a basis for positive consideration.

- creates an impact factor to recognize the important affordable housing and community development contributions of Low-Income Housing Tax Credit and New Markets Tax Credit investments

- Provides additional flexibility under the strategic plan option while continuing to meet the credit needs of communities.

- clarifies the option for any bank to request evaluation under a strategic plan and provides additional flexibility for banks with nontraditional business models

- strategic plans would need to reflect community input and meaningfully reflect that the bank seeking a plan will continue to meet the credit needs of communities if the plan diverges from the otherwise applicable performance tests

- Addresses feedback on the need to have additional time for banks to implement the new rule.

- increases the amount of time for banks to come into compliance with the new requirements (from 12 months to more than 24 months after the rule is adopted and published on the agency websites), balancing industry requests for additional time and the objective of implementing the regulations in a timely manner

- Retains and clarifies the provision on CRA ratings downgrades.

- for CRA ratings downgrades, maintains the current standard for “discriminatory or other illegal credit practices” rather than both credit and non-credit practices as proposed

- Ensures consideration of certain small business loans under the economic development category of community development.

- for certain loans to small businesses that meet a size and purpose test, allows consideration as a community development loan under economic development in addition to evaluation as a retail loan

Last Updated: October 24, 2023